A Detailed Guide on Nonprofit Balance Sheets +Sample

Donorbox is an affordable and simple-to-use online fundraising tool with powerful fundraising features such as Recurring Donations, Crowdfunding, Peer-to-Peer, Events, Memberships, and more. You can also manage donors, send them automated donation receipts, add offline donations, let donors login and manage their accounts themselves, and more on Donorbox. Operating revenue includes funds from donations, ticket sales, product sales, etc. Operating expenses are your employees’ salaries and the amount spent on equipment and supplies.

How to Read a Nonprofit Balance Sheet?

If the value of the donation is over $5,000, you should get the donation formally appraised by an expert. Once your vendor signs it, it’s a binding contract that tells you exactly how much you ordered from your supplier, how much you paid, and when the supplier agreed to deliver your order. They need an organized system that makes sure purchases are ordered, budgeted for, and fulfilled properly from the get go. Our team is ready to learn about your business and guide you to the right solution. Your team needs to spend countless hours entering receipts, invoicing clients, running payroll, and reconciling your books BEFORE you can get the reports you need to run your business the right way.

Understanding Nonprofit Financial Statements

We have noticed in working with clients that people often relate to accounting the same way they relate to their checkbook. In this framework, money going out is an expense and money coming in is income. When preparing your year-end impact reports, you can anticipate how your balance sheet may be perceived and incorporate that into the narrative. Having a proactive system for tracking the movement of funds during the year is the most difficult piece of reporting.

Mastering Mission Impact: A Step-by-Step Guide to Implementing the 4 Disciplines of Execution in Your Nonprofit

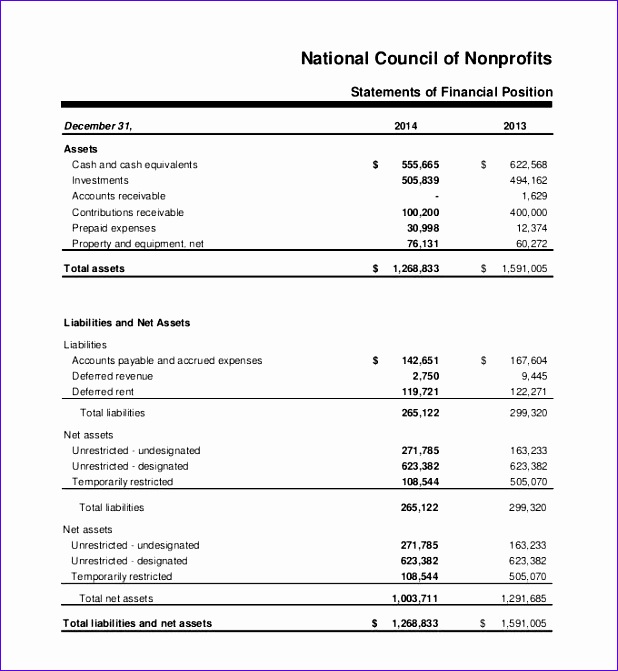

This part of the report shows the equity of your organization (your total assets minus your total liabilities). Learning about a nonprofit’s balance sheet is like peering into its financial backpack. Just as you’d check your own backpack to see what you have and what you owe, a balance sheet shows what a nonprofit owns like money and property and what it owes like bills or loans. Understanding this backpack helps everyone involved, like donors and leaders, know if the nonprofit is carrying a heavy load or if it’s light and agile.

- Internally you should create and use reports that give you the information you need to run your business effectively.

- It shows how funds are generated and how they are used to support the organization’s mission and programs.

- A few pieces may need to be found on the income statement or other financial statements.

- In this section, it is crucial to pay attention to the debt and accounts payable.

This type of accounting is similar to corporate accounting in many respects, but there are also rules, regulations, and reporting requirements specific to nonprofit organizations. External (audited) nonprofit financial statements must follow Generally Accepted Accounting Principles (GAAP) standards. That means must use accrual-basis accounting and record transactions in a specific way. A nonprofit’s statement of financial position, or balance sheet, provides a snapshot of an organization’s assets, liabilities, and net assets.

By analyzing the balance sheet, decision makers can make informed choices that are beneficial for the organization. When assessing the financial health of a nonprofit, it is important to look at both new financial and for-profit income statement. Financial analysis can be done by calculating financial ratios to determine the financial gain of the organization. Comparing the nonprofit’s financial ratios with industry benchmarks can provide insights into the organization’s financial performance.

Chances are you’ve looked at your organization’s profit and loss report and never thought much about the balance sheet. As with the for-profit sector, net assets represent the financial resources available to an organization after deducting liabilities. Not-for-profit organizations have a fiduciary responsibility to show their donors what their finances look like at the end of each fiscal year. Also, well-organized financial documents are necessary to understand the health of a nonprofit.

There are four financial statements nonprofits must file every year to remain in compliance with the IRS. But don’t fret – although it sounds complicated, these standard financial statements are easy to real estate accounting course compile with the right tools and guidance. In this article, we’ll walk you through the four types of statements and show you some examples of how other nonprofits handle their financial statements.

Understanding net assets involves a clear grasp of the nonprofit balance sheet, also known as a statement of financial position. The balance sheet reflects an organization’s financial health at a specific point in time. The left side of the balance sheet, also known as a statement of net assets, illustrates the resources a nonprofit organization owns, which determine its financial position. When an organization uses its balance sheet for financial planning, it can assess if it is in a strong financial position. The nonprofit balance sheet is called a picture of your financial and non-financial resources. Nonprofit financial management evaluates the typical balance sheet or statement of financial position to ensure a sustainable financial future.

Investments in property and equipment, on the other hand, would need to be sold to become liquid, making it challenging to use them for operating expenses. Read through it and see if you can draw any conclusions about Acme Nonprofit’s current financial status. Afterward, we’ll walk through what a donor might think when reviewing this information.